In This Issue

-

Amber Vilas ● In Plain Sight: Betty Beaumont

-

Randy Rosenberg ● Global: Art For Social Change

-

Sharon Spain ● California Dump: Nexus for Ecoart

-

Krystle Ahmadyar ● Ends of the Earth: Camille Seaman

-

Carol Newborg ● California Prisons: Art as Sanctuary

-

Mary Bayard White ● Colorado: The Flood Marker Project

-

Dr. Praba Pilar ● Ruptures In Technoculture

-

Patricia Watts ● Performative Public Art Ecology

-

Nanette Yannuzzi Macias ● Ohio: Turkish Ecoart Exhibit

-

Wu Mali ● Bringing Ecoart to Taiwan

-

Susan Leibovitz Steinman ● NO COMPLACENCY

TECHNOPHILIC SOCIETY

& INTERVENTIONIST PERFORMANCE

INTRODUCTION

IN FEBRUARY OF 2010, AN ARTICLE APPEARED IN WIRED Magazine on the further militarization of bioengineering. Â The US Defense Advanced Research Projects Agency (DARPA) included an item in its 2011 budget for the creation of a militarized living organism, titled BioDesign. Â The article noted:

Darpa is looking to re-write the laws of evolution to the military’s advantage, creating “synthetic organisms” that can live forever — or can be killed with the flick of a molecular switch… The plan would assemble the latest bio-tech knowledge to come up with living, breathing creatures that are genetically engineered to ‘produce the intended biological effect.’.”[1]

BioDesign, and related military projects merging humans with machines, represent a critical juncture for humanity in the definition, meaning and creation of life, and the harnessing of technology in advanced technological societies for the creation of living weaponry. Â What regulatory agencies, with which ethical mandates, will determine, regulate and manage the creation of new life forms through advanced technologies? Â The US military? Â Monsanto Corporation? Â Novartis? Â Who currently has, and who should have, the power to determine if this is a valid pursuit for humanity? Â Will BioDesign follow the same patterns as nuclear weapons and nuclear energy, where we end up with uncontrollable loads of toxic pollution and the possibility of mutually assured destruction? Â Is this the world we want to live in, where we create new life to engage in killing? Â Is it even a world we can accept living in?

The military and large global corporations have elevated the technological to a position outside of the knowledge/experience base of the public-at-large, all in the name of “progress” and of a “better living standard.” Â “They” – the technology corporations who have created 29 Superfund Sites in Silicon Valley – Â know better than “we,” the public-at-large, do. Â This positivistic view is technophilia, and the United States is a fully technophilic society. The scope of advancement is so extreme and rapid, developments emerge with a dizzying velocity, their dangers are subsumed into an unrelenting progress narrative. Â We have surpassed the slippery slope and moved into a dangerous ignorance of the life and death stakes at large.

I have generated art works for the last decade and a half that resist, contest and oppose unethical aspects of emerging forms of technological control and domination. Â Through my performances, installations, writing, protest, direct action, web sites, image making, radio appearances, public service announcements – all under the banner of art – I have tried to bring attention to technological advancements which affect us all, and introduce new modes of resistance and opposition that rupture technological determinism.

I. THE HEXTERMINATORS

Image from original website of Hexterminators, now at http://prabapilar.com/pages/projects/artactivist/index.html

MY INTRODUCTION TO THE NEGATIVE IMPACT OF emergent technologies came in 1998, while I was creating art projects with documented and undocumented immigrants and farm workers in the Salinas Valley.  While working with the Farm Workers Union on the Five Cents for Fairness campaign to improve the living and working conditions of strawberry workers, I received a stunning email describing the negative aspects of a new technology that was soon to be commercialized:  seed-sterilizing technology.

Written by Geri Guidetti, the email began:

There have been times in human history when the line between genius and insanity was so fine that it was barely perceptible. In the world of biotechnology and food, that line has just been obliterated. Announcements made over the past 90 days suggest that an ingenious scientific achievement and subsequent, related business developments threaten to terminate the natural, God-given right and ability of people everywhere to freely grow food to feed themselves and others. Never before has man created such an insidiously dangerous, far-reaching and potentially “perfect” plan to control the livelihoods, food supply and even survival of all humans on the planet.[2]

Guidetti was referring to seed-sterilizing technology, which prevents harvested seeds from being replanted, since seeds are rendered sterile in this process. Â This represented a threat to the worldwide practice of saved-seed farming. Â At the time, the Rural Advancement Foundation International[3]Â (RAFI then, recently renamed as the ETC Group) estimated that 1.2 billion farmers depended on saved-seed farming for their food supply. Â They renamed this technology “Terminator Tech.”

My research revealed an insidious wave of consolidation within not only the seed industry but what became the life sciences industry. Â I was concerned with the links between the corporations controlling agriculture, biotechnology and pharmaceuticals – and how this was turning into the corporate mega-structure of life sciences.

The urgency of this issue was profound. Â There was a limited window of opportunity to ban the Terminator from commercialization. Â I immediately began an ARTactivist campaign in San Francisco to bring attention to the issue of the Terminator, forming the Hexterminators with the Mexican artist Gerardo Perez. Â The name of the group came out of an artistic desire to attack irrational corporate greed with an irrational weapon: the hex. Â We put a hex on Monsanto Corporation and the Terminator through art interventions.

We recruited artists within the Latina/o community, EarthFirst! activists, students from multiple universities, agro-scientists, science policy educators, web designers, media artists, musicians, videographers, and others in San Francisco to do direct action, street theatre, agit-prop, art installations, radio appearances, television public service announcements, lectures, presentations, invisible theatre, theatre productions, web interventions and multiple interventionist projects. Â The group eventually grew to 25 people involved and at various levels of engagement over a three year period.

Dressed as superheroes, we took to the streets of San Francisco, Oakland, and Berkeley to pass out information and pamphlets. Â We invaded supermarkets and did our own labeling campaigns on genetically engineered produce and milk products. Â We trespassed, committed civil disobedience and teamed up with the Biotic Baking Brigade to throw a vegan pumpkin pie at the CEO of Novartis Corporation.

In February of 1999, Monsanto Corporation came to San Francisco to present genetically engineered cotton for the “From Field to Fashion” conference at the St. Francis Hotel. The Hexterminators teamed up with BayRAGE for operation fabRAGE: Â Fabulous Resistance Against Genetic Engineering, to disrupt the proceedings and indicate opposition and resistance to their products. Â We worked quickly on a six-page booklet modeled on Glamour Magazine, outlining the numerous environmental damages of Monsanto products, specifically focusing on seed- sterilizing technology.

The operation had two parts: internal dissent and external protest. The Monsanto representative was scheduled as the first speaker after lunch, so half of us, dressed in business attire, quietly entered the conference during the lunch hour and quickly placed the booklet on every participant’s chair. Â As the Monsanto representative took to the stage, he held up our booklet and began, “I’d like to address the issues raised in this booklet.” Â At this point the other half of the group broke into the hall, in glamorous gowns and did a noisy and raucous protest against Monsanto, stripping off our gowns and chanting: Â “GMOs, we won’t eat them, we won’t wear them.” Â We left as security arrived, and our collaborators quickly took to the microphones dispersed through the room and began challenging the Monsanto representative based on their history outlined in our booklet. Â Monsanto lost control of the presentation and was put in a defensive position throughout their allotted time.

As part of our strategy was to disseminate information widely, the next morning I was scheduled to be on the Terra Verde radio show on KPFA with a Monsanto representative, to discuss opposition to Terminator Tech.  Monsanto immediately canceled, which gave us the opportunity to accuse them of not wanting a dialogue, and instead to invite a representative of the Union of Concerned Scientists to talk about the specific problems with Terminator Tech.

The performances were manifold at this event. Â Hexterminator artists, normally superheroes, performed as corporate representatives through costuming, language and presentation of self. Â It allowed us entry into the event as participants, to disperse our literature and vocally oppose their products. Â This inside strategy was very damaging to Monsanto’s image. Â Simultaneously, through the outside protest, we were able to disrupt Monsanto’s presentation directly.

These performances, utilizing very limited funds and materials, used innovative tactics to bring attention to seed- sterilizing technology while rupturing the image of the well-funded corporate giant Monsanto Corporation.

II. LOS CYBRIDS: LA RAZA TECHNO-CRITICA

COROLLARY TO THE TERMINATOR THREAT WAS A different kind of technology-related explosion in my hometown of San Francisco which had a tremendous economic impact: the Internet boom. Â Low income families, artists, the homeless, all watched while our city was transformed in two or three short years by capital infusions from the tech sector. Â Who was affected? Â Low income families, immigrants, children, friends, colleagues, were driven into an exodus from San Francisco to escape the sky-rocketing rents and costs.

Fellow Latino artists John Leanos and Rene Garcia approached me in the summer of 1999 to create a project around the Internet boom.  Our questions were the same: who was benefiting from the boom and who was being pushed out?  We created a troupe, Los Cybrids: La Raza Tecno-Critica, to create performances, murals, street theatre, and panel discussions to raise these questions in dialogue with our communities and beyond.

I will focus on our performance at the Internet 2010 Conference held at El Rio, San Francisco in 2000.  Our disruptive performance brought us national attention, as a writer from Salon Magazine was in attendance, and immediately published a national article on our presentation which was reproduced and distributed intensely throughout the Internet.

The intent of this conference was to bring together progressives, non-profit technology directors and media groups from the Bay Area to stake out our claim to the Internet in the future.

John, Rene and I entered El Rio paramilitary style. Â John held our thesis in a bomb proof metal suitcase handcuffed to his wrist. Â Rene and I guarded him and his suitcase, frisking the attendants and confiscating their cell phones. Â Dressed as security guards, we were visibly prepared to take on anyone that tried to steal our materials. Â We were last on the panel, and John sat down with the suitcase, while Rene guarded him from behind. Â They both interjected mutters and shouts during the other people’s presentations.

The first person on the panel was Danny Schecter, executive editor of MediaChannel, a media organization in Boston. Â He extolled the virtues of the Internet for progressive organizing. Â Next up was a Brooke Biggs, producer of MoJo Wire, from Mother Jones Magazine, who went on at great length about wanting the Internet to still be available to non profits in the year 2010. Â There was a tone of despair in her presentation. Â Next up was Davey D from KPFA radio, the progressive station from Berkeley. Â He explained, in great detail, how to put up a website. Â Next was Tiny, aka as Lisa Gray Garcia, editor of POOR Magazine, who insisted that non- profits get a piece of the pie. Â Finally, it was our turn.

John put the suitcase on the table and carefully removed our thesis. Â He read our thesis, which was the beginning of our Manifesto. Â He expounded excitedly and volubly on our vision, to destroy the Internet through viruses, blowing it up. Â Rene and I chanted “The Internet Must Be Destroyed, Blow It Up, Disconnect, Downgrade, Unload” in the background.

The audience was startled, taken aback, exploding into laughter and applause and argumentation. Â Salon Magazine rushed out to write up the story, Schecter accused us of nihilism, Davey D was deeply offended, and Biggs wouldn’t even look at us. Â As moderator Larry Bensky asked John for our web address for further information, John yelled: Â “We don’t have a Web site! Get the fuck off the Web!”

The purpose of this performance was not to represent our genuine experiences, as we were as dependent on emails and the web as the next activist artist and we did, of course, have a website. Â The performance presented a vision of the world that stood outside of a totalizing technological matrix in order to disrupt the celebratory rhetoric. Â It presented our unpopular views at the time when the Internet and information technologies were vulnerable to the advancing armies of global capitalism in a war to promulgate an American-dominated global monoculture.

As Cybrids in constant performance mode, we used costuming, staging and radical theatre to present an anti-capitalist perspective from the center of the Cyber Empire, i.e. Silicon Valley. Â Our performance was designed to startle, to rupture, to disrupt, to present a completely unrealistic vision in order to change the frame of the debate and underscore the militaristic and capitalist roots of techno-culture.

I argue that this bizzare performance at El Rio in 2000 was effective in multiple ways beyond its shock value. Â This performance would not be effective in 2010. Â In the context of the recent near miss of year 2K and the popularity and newness of the Internet at that time, there was room for alternative views. Â The Internet was not as ubiquitous in 2000, and there was a space for radical hybrid cyborg Latina/os to provide a counternarrative to the underlying myths of progress and reification of progress narratives.

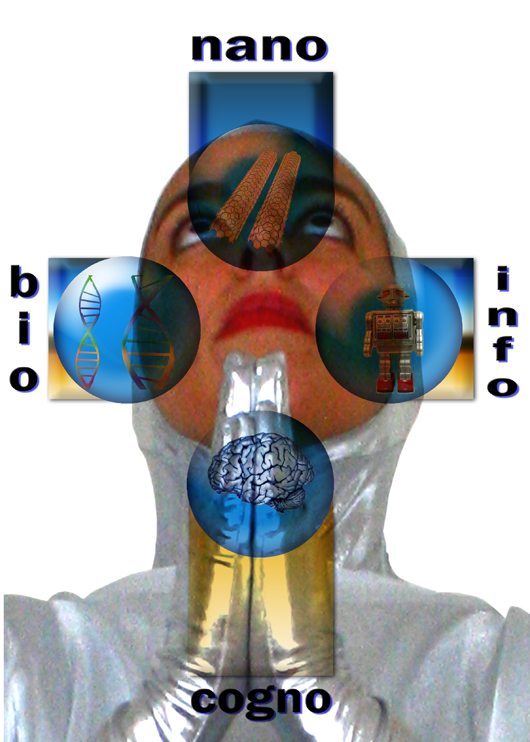

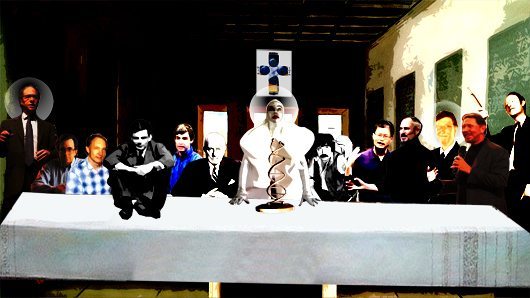

III. THE CHURCH OF NANO BIO INFO COGNO

IN 2006 I INITIATED AN ONGOING MULTIDISCIPLINARY project on the messianic rhetoric surrounding emerging technologies. Â Presented at universities, conferences, art galleries, museums and the Seminar in Experimental Critical Theory, it is a project that utilizes satire to critique technophilia directly.

I will focus on my street performances in New York City in April of 2011.

The cultural anthropologist Eben Kirksey, of the City University of New York Graduate Center, invited me to present the Church of Nano Bio Info Cogno in both performance and installation form in April of 2011.  He arranged for me to present at the opening of the MultiSpecies Salon at the CUNY Graduate Center, at the Cosmopolitics Conference, and on the Manhattan streets between 34th and 35th Streets and Fifth Avenue, half a block from the Empire State Building.

Standing on the streets in full reverential robes as a religious leader, I interacted with the locals and tourists who streamed by at a rapid clip. Â Presenting songs and stories of my religious conversion to full-on technophilia, handing out tracts of Church doctrine, chanting catechisms about technology, I read from the divine messages in Ray Kurzweil’s Age of Spiritual Machines, and stridently argued for a fully uploaded consciousness beyond the meat-ware, wet-ware and into the computing cloud.

The audience was constantly shifting, at different times aggressive, confused, supportive, overwhelmed or contradictory. Â I had long discussions over the two hours with singularitarians, methuselarians, and others who view our body as not much more than a faulty biological machine, separate from the mind and consciousness. Â Some discussions focused on military deployment of technology, while others focused on the lack of access by the general population to beneficial technologies. Â Most of the audience members I spoke to were ignorant of the pace and impact of technological development.

The performance used the language of positivist science, of their singularity, to disrupt technophilic society, and introduce these problematic and dangerous ideas to a broader audience.

IV. NO TIME FOR COMPLACENCY

I CONCLUDED WITH THE WORDS OF HUGO DE GARIS, a long-time researcher and developer in the field of artificial intelligence and currently director of the Artificial Brain Lab in the School of Information Science and Technology at Xiamen University, China.  As he notes in an article in Forbes Magazine:

“This will be the worst, most passionate war that humanity has ever known, because the stakes–the survival of our species–have never been so high. Given the period in which this war will occur, the late 21st century, with late 21st century weapons, the scale of the killing will not be in the millions, as in the 20th century (the bloodiest in history, with 200-300 million people killed in wars, purges, holocausts and genocides) but in the billions. There will be gigadeath.”[4]

It is urgent that individuals in the United States begin to disengage from the hegemonic framework of emerging technologies and engage the ethical dilemmas through an informed criticality. Â As my friend Mitchel Cohen used to tell me, “meet me at the barricades.”

RESOURCES:

Praba Pilar: Â http://www.prabapilar.com

Silicon Valley Toxics Coalition: Â http://svtc.org

ETC Group: Â http://www.etcgroup.org/en

Council for Responsible Genetics: Â http://www.

Union of Concerned Scientists: Â http://www.ucsusa.org/

EarthFirst! Journal: Â http://www.earthfirstjournal.

[1] Pentagon Looks to Breed Immortal ‘Synthetic Organisms,’ Molecular Kill-Switch Included, WIRED Magazine.  February 5, 2010.

[2]Â Food Supply Update: June 5, 1998. Â Seed Terminator and Mega-Merger Threaten Food and Freedom. Â Geri Guidetti

[3] The Rural Advancement Foundation International  has consultative status with the United Nations Economic and Social Council (ECOSOC), Food and Agriculture Organization (FAO), UN Conference on Trade and Development (UNCTAD), and UN Biodiversity Convention (CBD) and also has a long history with the Consultative Group on International Agricultural Research (CGIAR).